Whether you are a new investor or have had a well-tested seasoned portfolio for many years, your financial advisor has probably used the “D” word about a millions of times.

Diversification (also known as “not putting all of your eggs in one basket”) is the basis of Modern Portfolio Theory (MPT), the thesis of Nobel Prize-winning economist Harry Markowitz which he published in 1952. Till today, MPT is one of the most important and influential theories in modern day finance.

Modern Portfolio Theory says that it is not enough to look at the expected risk and return of one particular stock; rather, by investing in more than one stock, an investor can reap the benefits of diversification – chief among them, a reduction in the riskiness of the portfolio. MPT quantifies the benefits of diversification.

1. Reduces Portfolio Risk:

The overall risk in any portfolio is a combination of two types of risks: systematic and unsystematic. Systematic risk, also referred to as undiversifiable risk, is essentially the overall market risk which all stocks are exposed to and which cannot be mitigated through diversification. For example, the market crash of 2008 caused by the credit crisis resulted in 95% of the stocks trading lower, including companies that had very little or no exposure to housing and financials. (This degree of price movement which every individual stock experiences based on the overall market is measured by a metric called Beta.) On the other hand, unsystematic risk is specific to a company and/or industry and can be diversifiable. For example, a portfolio concentrated in a gold mining stock drops significantly because of a major disruption in its mine or a collapse in gold prices itself. This risk could be mitigated if the portfolio was diversified into a number of different stocks in different industries.

2. Enhances Risk Adjusted Return:

When evaluating the return a portfolio, it isn’t enough to simply look at the final number. Just as important is the need to look at the risk it took to get that return. For example, let’s say two separate portfolios yielded 7% for the year; however one was diversified while the other was concentrated in biotech stocks only.

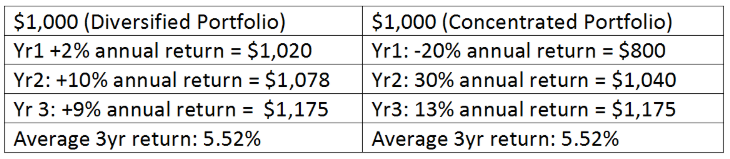

Although both portfolios yielded the same return, the latter took on much more risk (measured by standard deviation) and most likely was more volatile during the same time span. As the example below demonstrates, over the long term, this concept becomes even more important as diversified portfolios allow for a more consistent and smoother return vs concentrated portfolios.

3. Balancing your Economic Balance sheet:

We’ve all heard of the traditional assets and balance sheet, but what is an Economic balance sheet? Every individual’s assets are made up of two main components: financial capital and human capital. Financial capital are all tangible (i.e. real estate) and intangible (i.e. stocks) assets owned by an individual. Human capital, also called net employment capital, is an implied asset; that is the net present value of an investor’s future income taking into account the probability of survival. Combined, these two components make up the assets on an individuals Economic Balance sheet.

To illustrate what is human capital and how it applies to investing, consider the following example:

An engineer working in the oil and gas sector will have a human capital that is heavily correlated to the earnings of the oil and gas sector, which is very cyclical and volatile. When looking at the engineer’s financial capital (i.e. their investment portfolio), a diversified portfolio with an underweighting in energy stocks would bring balance to the engineers economic balance sheet and reduce overall risk on their net wealth.

Often investors will have a bias in the fields they work in and are familiar with, translating to them overweighting their investments into that sector. A diversified portfolio helps to ensure that the traditional assets are invested to complement the investor’s human capital.

4. Increase exposure = Opportunity:

A diversified portfolio strategy will expose an investor to assets, sectors, and stocks that the investor may not otherwise be exposed to. Markets often experience a period of rotation where certain sectors see an inflow of capital at the expense of another, resulting in one sector outperforming another. This means that the worst performing sector – or market – could potentially be one of the best performing in the following year. For example, an investor who has only invested in US stocks would not capitalize if international markets started to outperform in the following years. The discipline of diversification can lead to a portfolio always having some exposure to leadership sectors and markets.

5. Keep Calm & Diversify On:

A diversified portfolio reduces the time spent in monitoring the portfolio, helps better achieve long-term investment, and in turn brings more peace of mind. A diversified portfolio is more stable because not all investments will move in sync, making it less susceptible to huge movements in the market. In addition, a more predictable return with less volatility can help investors not to lose focus and/or get emotional, resulting in a bad investment decision. For example: investors who were heavily concentrated in technology stocks prior to the 2001 tech bubble had their long-term financial plans in disarray following the crash. This may have resulted in more emotional and professional stress, which can cause in turn cause bad investment decisions.

“O mankind, what has deceived you concerning your Lord, the Generous, Who created you, proportioned you, and balanced you?” [Surah Al-Infitar, 6-7]

“Thus, have We made of you an Ummat justly balanced…” [Surah Al-Baqarah, 143]

Principled moderation is one of the defining characteristics of good character in Islam.

Islam teaches us to be moderate and balanced in all aspects of life, whether it is religion, relationships, daily activities or even investing. After all, if our Creator has created us in a balanced manner, should we not strive to balance our investments as well?

At ShariaPortfolio our team has a disciplined approach and offers a comprehensive solution to investing that utilizes diversification. We select from an array of Sharia-compliant investments (individual stocks, Sukuk, precious metals, and mutual funds) to make up each personalized portfolio, and use a broad diversified approach in our allocation, staying away from big concentrated bets that could expose our portfolio to undue higher risk. In addition, our portfolios are regularly monitored, updated and rebalanced.

For more information please call us at (321) 275-5125 or send us an email at info@shariaportfolio.com.

Investing in securities involves risk, and there is always the potential of losing money when you invest in securities.

Halal compliant investments, diversification and asset allocation do not ensure a profit or protect against loss.

This material is intended for informational purposes only and should not be construed as legal or tax advice, nor is it intended to replace the advice of a qualified attorney or tax advisor.