About ShariaPortfolio

A boutique asset management firm specializing

in socially responsible and halal investing

About

ShariaPortfolio

![]()

With over 15 years of experience working in diverse market conditions, we apply a rigorous research and analytics approach to wealth management, focusing on value investing for long-term results. ShariaPortfolio is pleased to offer its brand of Sharia-compliant investment services in many countries around the world.

Our Team

Experienced and trusted professionals working diligently to determine suitable investment strategies

and build custom portfolios that adhere to Islamic principles and personal values.

Naushad Virji

Founder, Chairman of the Board, Portfolio Manager

Aliredha Walji

CEO

Glenn Vitale

CFO

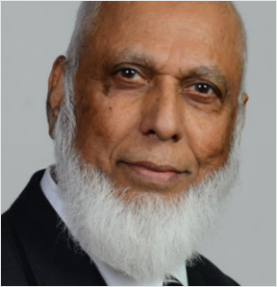

Shaykh Umer Khan

Sharia Advisor

Habib Anwar

Advisor Team Manager

Farhat Shirazi

Client Service Manager

Lori Sabino

Operations Manager

Fatema H. Alidina

Executive Assistant to Founder

Shafaq Kazi

Investment Advisor Representative

Rezwana Abed

Investment Advisor Representative

Ishaq Mohiuddin

Investment Advisor Representative

Allan Paull

Investment Advisor Representative

Fatemeh Astani

Marketing Specialist

Kautia Holloway

Client Service Associate

Destiny Rosario

Client Service Assistant Manager

Murtaza Kermalli

Accounting Manager

Carlos Perez

IT Administrator

Siraj Virji

Intern

Sarrah Virji

Bookkeeping Clerk

Is there a minimum initial investment to open an account with ShariaPortfolio?

To open an account with our digital Express robo-advisor, the minimum initial amount is $1,000. For our Access personal wealth management service, the minimum initial amount is $100,000. Please note that this can include several accounts with ShariaPortfolio. For example, you may have a rollover IRA, a joint account and an education savings account with us that, together, come to a total of $100,000 or more. Our advisors look forward to working with you to achieve your financial goals!

What do your services cost?

Flat Managment Fees are charged based on assets under management. ShariaPortfolio offers two levels of service:

- Express (Robo-Advisory): 0.50% – 0.75% per annum

- Access (Advisor Assisted): 1.50% per annum

The fees are charged on a quarterly basis at the beginning of each quarter. Unlike many other advisory firms, we do not charge fees for placing trades nor do we take commissions from mutual fund companies. We are also fiduciaries, which means that we are legally obligated to place our clients’ interests first. At ShariaPortfolio, you can rest assured that you’ll receive unbiased advice and expertise.

How do I know my money is safe with your firm?

ShariaPortfolio uses reputable custodians, such as Schwab, to hold your portfolio. Clients have 24/7 access to their accounts with no long-term commitments. Your money will be managed according to your objectives, risk tolerance and preferences.

What are the Sharia guidelines used to screen global equities?

The Sharia guidelines are based on the rules determined by the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI), a global Islamic finance standards-setting body, governed by an international panel of highly respected Sharia scholars, and are as follows:

Asset classes

Only stocks and Islamic ETFs are eligible for Shariah-compliance consideration. Preferred shared are considered to be non-compliant.

Business activities screens

Companies are only to be considered compliant from a business perspective if the cumulative revenue from non-compliant activities and non-operating interest income does not exceed 5% of their total income. Non-compliant income sources include the following:

- Alcohol

- Gambling

- Weapons

- Tobacco

- Adult Entertainment

- Pork Products

- Highly-leveraged Businesses

- Interest-Based Businesses

- Music, Cinema or Broadcasting

Financial screens

- Interest-bearing debt divided by 12-month average market capitalization should be less than 30%

- Cumulative revenue from non-compliant activities and non-operating interest income should not exceed 5% of total income

- Cash, cash equivalents and short-term investments divided by the 12-month average market capitalization should be less than 30%

What is the difference between ShariaPortfolio and a mutual fund?

ShariaPortfolio offers a comprehensive solution to investing that includes a variety of Sharia-compliant stocks and mutual funds. You can think of mutual funds as products being offered by investment companies. Financial advisors like ShariaPortfolio offer services whereby they help investors by managing their investments, which may include mutual funds and individual stocks.

Can I choose some of the stocks to add to my portfolio?

Yes. We’re pleased to offer a fully customized solution for your investment needs through our Access personal wealth management service. You can request that we add a stock or fund to your portfolio anytime.

How long has ShariaPortfolio been around?

ShariaPortfolio, Inc. is an investment advisory firm registered with the Securities and Exchange Commission. Virji Investments, Inc. launched the ShariaPortfolio brand in 2003. After years of successful growth, ShariaPortfolio became a separate corporation in 2014. The firm now has clients in more than 25 states and around the world.

Omars Sulessiman has joined ShariaPortfolio as an Ethical Advisor. Read More >

Rezwana Abed

![]() Phone: (321) 275-5125

Phone: (321) 275-5125

![]() Email: rezwana@shariaportfolio.com

Email: rezwana@shariaportfolio.com

Rezwana holds an undergraduate degree in Environmental Economics and a Master’s degree in Public Policy from UC Berkeley. Rezwana’s previous work experiences extended across nonprofit sectors and academia where she contributed to research, policy analysis, and program evaluation capacities. In addition, she taught undergraduate and high school level economics courses for several years.

While investment advising wasn’t Rezwana’s primary calling, it fast evolved into one of her passions ever since she started to self-educate and took an active role in trying to achieve her own family’s goal of financial security. Rezwana hopes to bring her unique perspective and life experiences to help clients navigate their critical financial decisions with clarity and confidence.

Rezwana was born in Bangladesh and has lived in the United States since 2004. She currently resides in sunny California with her husband and a young daughter. In her spare time, Rezwana enjoys traveling to new places, mastering new DIY crafts, and spending time with family and friends.

Carlos Perez

![]() Phone: 321-275-5125 Ext. 814

Phone: 321-275-5125 Ext. 814

![]() Email: carlos@shariaportfolio.com

Email: carlos@shariaportfolio.com

Carlos Perez is an award winning and nationally recognized Technology Professional with years of IT Infrastructure at the Microsoft Corporation. Principal of Perez Technology Group, Perez is a Microsoft Certified & Dell Certified Professional who specializes on the development of Technology solutions that solve business needs for small and medium size businesses. He has been responsible for the migration, deployment and management of Cloud based solutions across vertical markets including Fortune 100 companies. He has specialized experience in the Finance, Insurance, Marketing, Legal and Health Care industries & delivered IT projects support to Media Agencies & Non-Profit Organizations.

Perez is also a published author and a featured Tech expert on the Hartford Business Journal & the Orlando Business Journal. He has been featured on the Technology publication CRN, The Channel Company, Spectrum News in Florida, WAPA America, Telemundo NBC Universal & New York 1 for his IT expertise. He was awarded the Entrepreneur of the Year award by the Connecticut Minority Supplier Development Council & the Global Entrepreneur of the Year award by The National Foundation for Teaching Entrepreneurship (NFTE). He previously served as a Manager for Microsoft FastTrack Center, a customer success service designed to help customers realize business value with the Microsoft Azure Cloud and Office 365. Perez is a member of the Microsoft Partner Network & studied Business IT at the University of Connecticut.

Siraj Virji

![]() Phone: 321-275-5125

Phone: 321-275-5125

![]() Email: siraj@sp-funds.com

Email: siraj@sp-funds.com

Siraj is an undergraduate student working toward an MBA with a scholarship at Rollins College. Though having spent a few years in Vancouver, Canada, he has spent most of his life living in Orlando, Florida. Siraj also volunteers as a member of his mosque’s outreach team, coordinating events and writing articles.

Having extensive experience with a myriad of coffee machines, Siraj is equipped with all the skills necessary to produce a colleague’s morning latte in a timely manner. All jokes aside, as he works on the organizational aspects of the company, Siraj is an attentive and diligent worker dedicated to growing as an asset in his role.

Siraj Virji

![]() Phone: 321-275-5125

Phone: 321-275-5125

![]() Email: siraj@sp-funds.com

Email: siraj@sp-funds.com

Siraj is an undergraduate student working toward an MBA with a scholarship at Rollins College. Though having spent a few years in Vancouver, Canada, he has spent most of his life living in Orlando, Florida. Siraj also volunteers as a member of his mosque’s outreach team, coordinating events and writing articles.

Having extensive experience with a myriad of coffee machines, Siraj is equipped with all the skills necessary to produce a colleague’s morning latte in a timely manner. All jokes aside, as he works on the organizational aspects of the company, Siraj is an attentive and diligent worker dedicated to growing as an asset in his role.

Shaykh Umer Khan

![]() Phone: 321-275-5125

Phone: 321-275-5125

![]() Email: umer@shariaportfolio.com

Email: umer@shariaportfolio.com

Shaykh Umer Khan graduated with the highest marks in his class in his formal Shahādah al-‘Ālimiyyah degree (License in Islamic Scholarship, i.e. ʻālim program) from Al-Salam Institute, authorized by Dar al-ʻUlūm Nadwat al-ʻUlamā', Lucknow, India. He also completed a traditional Dars-e-Niẓāmī dawrah of the six canonical books of ḥadīth. Shaykh Umer completed his iftā' (License to Give Islāmic Legal Verdicts) from Darulifta Birmingham, granting him the traditional title of 'mufti'. He has a Master's in Finance (from Wharton, UPenn) and another Master's in Islamic Finance and he holds several professional certifications and qualifications in Islamic Finance.

Shaykh Umer teaches the Islamic sciences at seminaries (Institute of Knowledge, Al-Salam Institute, and Critical Loyalty), researches and writes fatwās (legal verdicts) for various institutions, and serves as a sharīʻah advisor to a number of companies.

Shaykh Umer will be working to help ShariaPortfolio with developing a more concrete framework for Sharia screening, reviewing our operations and portfolios to have better alignment with AAOIFI guidelines. InshaAllah we hope this helps increase confidence with our clients in regard to Sharia compliance.

Fatemeh Astani

Marketing Specialist

Habib Anwar

Advisor Team Manager