Editor: Irfan Chaudhry

Gold price has made more headlines lately as it has outshone other investments in last few years, but nothing has shone brighter than silver since start of second half of 2019.

As one of the seven metals of antiquity, silver has been valuable in societies in history. Sophisticated investors had been using silver investing for ages. Silver prices peaked in early 2011 at close to US$50.00/oz and subsequently gradually declined to a low of US$13.70/oz in late 2015, around the same time when gold prices hit their low. However, unlike gold – which since trended higher, and is up 40% from the lows – silver prices have largely remained stagnant.

Why Has Silver Price Lagged Gold Price

Silver prices are driven both by monetary and industrial demand. Historically, the photography has accounted for the lion’s share of industrial silver demand. In 2018, the photography absorbed just under 40 million ounces, down from around 200 million ounces (1/3 of global mine supply) twenty years ago. However, solar panel manufacturing consumed over 80 million ounces in 2018 (10% of mine supply) and is growing. Demand from the photo-voltaic industry is new, and while rapidly accelerating, it hasn’t been large enough over the past five years to fully compensate for the loss in photography demand. Hence, in total, industrial demand was slightly trending down from 2013 to 2017. On the other hand, the supply of silver was high from 2015 till 2018 as silver used in photographic films was recycled. This caused silver market surpluses from 2015 till 2017, which weighed on silver price.

Twelve Things to Know About Silver

In the environment of tit for tat trade tariff war, collapse in yields, Brexit uncertainty, geo-political tensions and loose monetary policy, it may be very helpful to look at different drivers of silver price. An awareness of these market movers will help you understand why silver trends up or down in both short-term and long-term.

1. Industrial Demand: Going forward, analysts do not expect weak industrial demand to pose any more headwinds for silver prices. One reason is that demand from the photography sector cannot get much lower while industry experts expect demand from the photovoltaic industry to continue to rise.

2. Monetary Demand: A decline in industrial demand, even small one, as over the past years, can affect silver prices negatively in a normal environment – it becomes secondary in a period of strong monetary demand, as industrial demand is usually weak anyways. The silver cost curve has a discontinuous shape, meaning that base production is relatively cheap — but any addition is very expensive. Hence, when a sharp increase in monetary demand leads to a shift on the cost curve, prices tend to increase sharply.

3. Poor Man’s Gold: When gold price rises and remain elevated for an extended time, and silver price lags, this diverts substantial portion of inflexible Jewellery demand from gold to silver.

4. Safe Haven Investment: Silver, along with gold, is a safe haven investment. This means that silver is seen as retaining its value and purchasing power better than paper currency and certain other assets when there is economic uncertainty as it is now.

5. Global Macro Trends: As with gold, silver is often affected by global economic trends. The dollar has been a driving force behind the price of silver. News for the dollar recently have been gloomy. This can drive the price of Silver higher as investors turn to hard assets.

6. Inflation: Most investors understand the insidious nature of inflation on portfolio value. This includes even nominal inflation compounded over long periods of time. Silver, on the other hand, is seen historically as a great hedge against that inflation.

7. Falling Interest Rates: Drop in interest rates make silver investment more attractive as lure of yield relative to long-term appreciation of silver holdings dims. Therefore, silver’s market prices generally have an inverse relationship with the level of interest rates.

8. Falling Scrap Supply: It is worth noting that the Silver Institute studies show much of the readily accessible stockpiles of silver scrap have been exhausted.

9. Declining Mine Supply: According to the Silver Institute, silver mine supply has peaked in 2015/2016, and have since been declining due to a long period of underinvestment. Mine supply already declined 2% in 2018 and the Silver Institute forecasts that it will decline again by 2% this year.

10. Recent Deficits: Silver supply is limited but demand is constant. Any perceived or actual increase or decrease in supply or demand will disproportionately move prices. Silver has been running a deficit for the last two years, which should be supportive of increase in silver price.

11. Low Stocks & Thin Market: Silver market is significantly smaller than the gold market. In current environment, two factors may become dominant supporters for silver prices: Low above-ground stocks of silver and the discontinued shape of the silver cost curve.

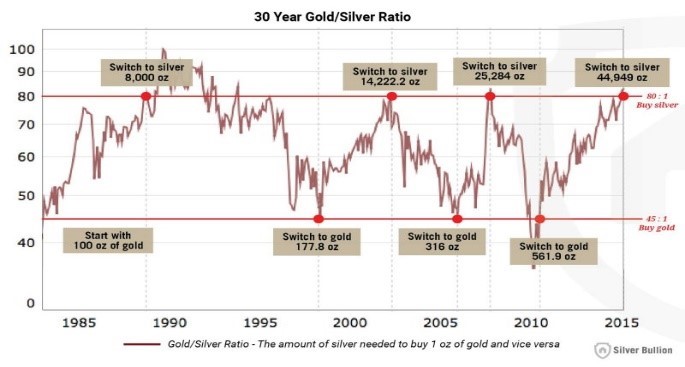

12. Gold to Silver Ratio: In general terms, as the price of gold moves up or down, silver prices will follow. Gold to silver ratio reflects relative value of Gold and Silver. At the time of writing (Sept 2019) Gold to Silver ratio was at nearly 86, which is an extreme only touched four times in recent years; 1990, 2003, 2008 and 2016. Crossing this extreme in recent years has usually been followed by a quick drop to more reasonable ratios of 53 (in 2004), and 68 (in 2011). Since March 1970, the average gold to silver ratio is 551. Another way to look at this is a hypothetical case of switching between gold and silver investment when gold to silver ratios are at extreme. If we start with a 100 Oz of gold in 1985 and keep conscientiously switching the investment when the ratio touches either extreme, that may have increased our wealth by five times.

We think that the reasons for subdued performance of silver are transitory and that silver will outperform gold again. Forecasting the price of any commodity – silver included – is always a question of informed opinion, rather than absolutes. ShariaPortfolio advisors can help you to make an informed opinion based on analysis and historical patterns. Investors can buy silver bullion or physical Silver ETF shares, which has been certified as Shariah Compliant according to the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI).

Please seek professional help from your ShariaPortfolio Advisor. For more information please call us at (321) 275-5125 or send us an email at info@shariaportfolio.com.

Investing in securities involves risk, and there is always the potential of losing money when you invest in securities.

Halal compliant investments, diversification and asset allocation do not ensure a profit or protect against loss.

This material is intended for informational purposes only and should not be construed as legal or tax advice, nor is it intended to replace the advice of a qualified attorney or tax advisor.