Editor: Aliredha Walji

Contributor: Shafaq Kazi

Islam is a religion which encourages us to give.

The obligatory charity, zakat, is mentioned right alongside prayer numerous times in the Holy Qur’an, while recommended charity is said to protect us against calamities and hardships. It expiates our sins, pleases God, and acts as a hedge in our Spiritual Portfolio against unexpected losses. Its importance is so high that it has been given the position as one of the pillars of Islam.

Charity is also the smartest investment a believer can ever make. Its dividend returns in the hereafter are guaranteed, along with growth in multiples of what was initially invested.

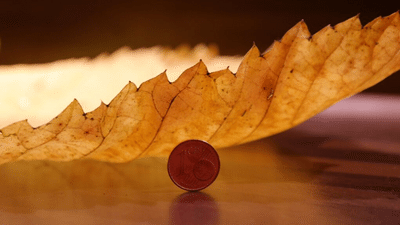

The Holy Qur’an specifies that the one who gives charity will be rewarded exponentially: “The likeness of those who spend their wealth in the Way of Allah, is as the likeness of a grain (of corn); it grows seven ears, and each ear has a hundred grains.” (2:261)

Though the rewards of charity have been made available to those of all financial situations (as the Holy Prophet has said, “Even a smile can be charity”), the above verse speaks particularly about spending wealth – which should come as no surprise given the benefit that can be derived from wealth when it is used for the good of the Muslim Ummah. To examine this idea in more detail, one need look no farther than the example of Lady Khadija (ra).

Khadija’s (ra) vast wealth helped to protect the Muslims and aid the mission of the Holy Prophet (pbuh) to such a degree that it is credited with supporting the rise of Islam itself. From Khadija (ra), we learn that wealth leads to strength, something which Islam, as a holistic religion, encourages in all aspects of our lives, whether it be physically, mentally, emotionally, or financially.

“A strong believer is better and is more lovable to Allah than a weak believer”

(Muslim).

But isn’t it wrong to want too much wealth?

Acquiring wealth has long been debated as an evil, and conflated with attachment to this temporal world. God Himself warns us, in the first verses of Surah Takathur, not to let abundance divert us from the true goals of life, until it is too late and we are in our graves. Given this, should not believers learn to be content with what they have instead of constantly striving to acquire more?

While it is true that over indulgence and obsession with acquiring material does indeed divert one from the true goals of life, this is different from trying to acquire wealth with a greater purpose and intention in mind. When acquiring wealth is a goal in and of itself, it can lead to disaster, causing a person to neglect themselves and others in the pursuit of material wealth. However, we know from the example of Lady Khadijah (ra) that this is not the only type of acquisition that exists. Although she worked hard and was at the top of her game, Khadija (ra) never lost sight of her goals, eventually using up all of her wealth in noble causes to support the Holy Prophet (pbuh) and the spread of Islam.

Islam is a practical way of life. It does not deny its followers the right to acquire wealth.

On the contrary, as Muslims, it is our responsibility to seek halal sustenance (rizq) and strive to be self-sufficient financially to take care of our family and community – in other words, to seek out wealth for the right reasons and using the right methods. As long as we remember that wealth belongs to Allah and should be seen as a means to attain His pleasure, we can ensure that we are attaining it for the right reasons, and can use it as an investment for a future in Jannah, insha-Allah.

How do I attain financial strength for the sake of Allah (swt)?

When thinking about investing, the first and most important place to start is to make sure that the investments are halal.

Most traditional portfolios invest in non-halal sectors – such as alcohol, gambling, weapons, and adult entertainment – as well as in businesses with high percentages of debt. In order to avoid this, individuals can choose to invest their 401K plans into money market accounts, or can utilize the existing halal investment options that are on the market.

For those who are looking for more help with managing their investment portfolios, however, ShariaPortfolio, Inc. offers a full-service, boutique asset management service specializing in Sharia-compliant investing. We believe in carefully maintaining social responsibility and emphasizing ethics in our investment choices and offer a wide range of solutions – comprehensive wealth management solutions, robo-advisor service, 401(k) plans for businesses and co-managed accounts for non-Sharia-compliant advisors – providing customized services not available at most large brokerage firms.

To begin your journey with a free consultation, please call us at 888 HALAL-STOCKS (888-425-2578) or send an inquiry toinfo@shariaportfolio.com. One of our licensed financial advisors will get in contact with you to discuss how we can help you achieve your financial goals – for the success of both your life in this world and the hereafter.

Investing in securities involves risk, and there is always the potential of losing money when you invest in securities.

Halal compliant investments, diversification and asset allocation do not ensure a profit or protect against loss.

This material is intended for informational purposes only and should not be construed as legal or tax advice, nor is it intended to replace the advice of a qualified attorney or tax advisor.