Relationship Summary – Form CRS

APPENDIX

Is an Investment Advisory Account Right for You?

There are different ways you can get help with your investments. You should carefully consider which types of accounts/services are right for you.

Depending on your needs and investment objectives, we can provide you with services in an investment advisory account. This document gives you a summary of the types of services we provide, as well as the associated fees and costs. We encourage you to ask us for more information and have provided suggested questions at the bottom of this page.

Investment Adviser Services

Advisory Accounts

Types of Relationships and Services. Our accounts and services.

- ShariaPortfolio, Inc. (“Firm” or “ShariaPortfolio”) is a fee-only registered investment advisor focusing on Sharia-compliant investing to assist you, our client, achieve your financial goals. We refer to persons or entities to which we provide investment advice as a “Client” or “Clients.” The securities we use in our model portfolios will be a mix of equity (“stock”) positions, Investment Company (“mutual funds”) products, and Exchange-Traded Funds (“ETFs”) based on your unique investment expectations and risk tolerance levels.

- If you open an advisory account, you will pay an on-going asset-based fee for our services. We will offer you advice on a regular basis. We will discuss your investment goals, design with you a strategy to achieve your investment goals, and regularly monitor and/or rebalance your advisory account to align with the model/strategy that was discussed with your financial professional. We will contact you (by phone or e- mail) at least annually to discuss your portfolio. Please note that advisory account refers to those established under our Access Program.

- You can choose an account that allows us to buy and sell investments in your account without asking you in advance (a “discretionary account”) or we may give you advice and you decide what investments to buy and sell (a “non-discretionary account”).

- The Firm sponsors a wrap program, wherein it offers its discretionary portfolio management services via an automated online interactive website (the “Express Program”). Details regarding this program are outlined in our Form ADV Part 2A – Appendix 1 (“Wrap Brochure”).

- As it is related to retirement planning, the Firm assists ERISA-qualified retirement and savings plans in the design of the fiduciary governance structure and with the development of an investment management program. Our services under ERISA are to act as a Limited-Scope 3(21) Fiduciary. As such, we acknowledge we have a co-fiduciary role but do not take discretion or act as a 3(38) Fiduciary to construct an investment menu, select and monitor money managers, mutual funds, or ETFs or to replace the investment options within the plan.

- The Firm also advises Registered Investment Companies, including ETFs (SPSK, SPUS). The SP Funds Dow Jones Global Sukuk ETF (the “Fund” or the “Sukuk ETF”) seeks to track the performance, before fees and expenses, of the Dow Jones Sukuk Total Return (ex‑Reinvestment) Index (the “Index” or the “Sukuk Index”). Toroso Investments, LLC (the “Adviser”) serves as investment adviser to the Fund. CSat Investment Advisory, L.P. d/b/a Exponential ETFs (“Exponential”) and ShariaPortfolio, Inc. (together, the “Sub-Advisers”) serve as investment sub-advisers to the Fund. The Fund generally may invest up to 20% of its total assets in Sharia-compliant securities or other investments not included in the Index, but which the Fund’s sub-advisers believe will help the Fund track the Index.

- ShariaPortfolio also manages one private fund, SP Fund RE, LLC, a Florida limited liability company (the “Fund”), that qualifies for the exclusion from the definition of investment company under section 3(c)(1) of the Investment Company Act of 1940, which seeks to acquire, directly or indirectly, interests in mixed use commercial, industrial, multi-family, and residential real estate investments (the “Investments”) which are to be selected by the SP Funds Management, LLC, a Florida limited liability company (the “Manager”). As of August 21, 2019, the Interests in the Fund are generally being offered to “Accredited Investors” as that term is defined by Rule 501 of Regulation D promulgated under the Securities Act. However, the Fund is permitted to admit no more than 35 non-accredited investors as Investors and, at the discretion of the Manager, the Fund will admit such investors provided they are able to make the minimum investment.

- Given our focus on Sharia-compliance, our investment advice will cover a limited selection of investments. Other firms could provide advice on a wider range of choices, some of which might have lower costs.

Our Obligations to You. We must abide by certain laws and regulations in our interactions with you.

- We are held to a fiduciary standard that covers our entire investment advisory relationship with you. For example, we are required to monitor your portfolio, investment strategy and investments on an ongoing basis.

- Our interests can conflict with your interests. We must eliminate these conflicts or tell you about them in a way you can understand, so that you can decide whether or not to agree to them.

Fees and Costs. Fees and costs affect the value of your account over time. Please ask your financial professional to give you personalized information on the fees and costs that you will pay.

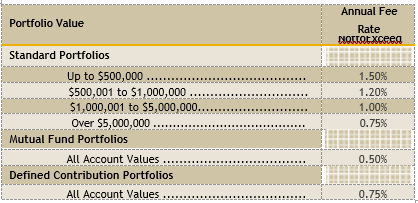

- Asset-based fees. Portfolio management services are provided on an asset-based fee arrangement. All client assets, including dividends, are aggregated for purposes of calculating the management fee. To this end, the fee will be based on the value of the assets in the client’s advisory account at the end of the previous quarter as calculated by the portfolio manager, and not the custodian. We retain discretion to negotiate the management fee within each tier on a client-by-client basis depending on the size, complexity, and nature of the portfolio managed. In addition, as your portfolio value exceeds each tier level, either through additional deposits or asset growth, a fee break will occur. The tier breaks are as follows:

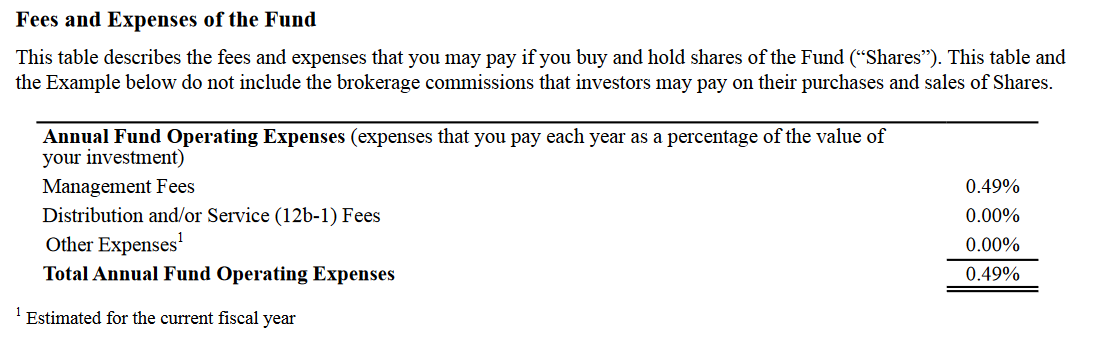

- As it relates to ETFs and mutual funds, this table describes the fees and expenses that you may pay if you buy and hold shares of the SPUS Fund (“Shares”) as an example. This table and the Example below do not include the brokerage commissions that investors may pay on their purchases and sales of Shares. Please see our ADV Part 2A for fees for similar funds offered. You may also review the Fund’s offering material, including prospectus.

- The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Shares are held in a taxable account. These costs, which are not reflected in total annual fund operating expenses or in the expense example above, affect the Fund’s performance. Because the Fund is newly organized, portfolio turnover information is not yet available.

- The Fund generally will pay the Adviser an annualized management fee of up to 1.20%. The Manager and/or its affiliates will manage certain aspects of each applicable Investment in real estate (each a “Real Estate Investment” and collectively, “Real Estate Investments”) and provide certain services, and in connection therewith, the Fund will pay to the Manager an annual management fee equal to 1.20% of assets of the Fund, payable monthly in arrears from the Capital Account of each Investor.

- Some investments (such as mutual funds and variable annuities) impose additional fees that will reduce the value of your investment over time.

Conflicts of Interest. We benefit from the services we provide to you.

- ShariaPortfolio does recommend that Clients buy or sell any security in which a related person to ShariaPortfolio or ShariaPortfolio has a material financial interest. From time to time, representatives of ShariaPortfolio may buy or sell securities for themselves that they also recommend to Clients. This may provide an opportunity for representatives of ShariaPortfolio to buy or sell the same securities before or after recommending the same securities to Clients resulting in representatives profiting off the recommendations they provide to Clients. Such transactions may create a conflict of interest. ShariaPortfolio will always document any transactions that could be construed as conflicts of interest and will never engage in trading that operates to the Client’s disadvantage when similar securities are being bought or sold.

Additional Information. We encourage you to seek out additional information.

- For additional information about our services, visit Investor.gov, our website (https://shariaportfolio.com/), and your account agreement. For additional information on advisory services, see our Form ADV brochure on IAPD, on Investor.gov, or on our website (https://reports.adviserinfo.sec.gov/reports/ADV/173937/PDF/173937.pdf) and any brochure supplement your financial professional provides. To report a problem to the SEC, visit Investor.gov or call the SEC’s toll-free investor line at (800) 732-0330.

Key Questions to Ask. Ask our financial professionals these key questions about our investment services and accounts.

- How much would I expect to pay per year for an advisory account?

- What additional costs should I expect in connection with my account?

- What are the most common conflicts of interest in your advisory accounts?

ShariaPortfolio, Inc.

Investment adviser registered with the Securities and Exchange Commission, June 25, 2020

Omars Sulessiman has joined ShariaPortfolio as an Ethical Advisor. Read More >

Rezwana Abed

![]() Phone: (321) 275-5125

Phone: (321) 275-5125

![]() Email: rezwana@shariaportfolio.com

Email: rezwana@shariaportfolio.com

Rezwana holds an undergraduate degree in Environmental Economics and a Master’s degree in Public Policy from UC Berkeley. Rezwana’s previous work experiences extended across nonprofit sectors and academia where she contributed to research, policy analysis, and program evaluation capacities. In addition, she taught undergraduate and high school level economics courses for several years.

While investment advising wasn’t Rezwana’s primary calling, it fast evolved into one of her passions ever since she started to self-educate and took an active role in trying to achieve her own family’s goal of financial security. Rezwana hopes to bring her unique perspective and life experiences to help clients navigate their critical financial decisions with clarity and confidence.

Rezwana was born in Bangladesh and has lived in the United States since 2004. She currently resides in sunny California with her husband and a young daughter. In her spare time, Rezwana enjoys traveling to new places, mastering new DIY crafts, and spending time with family and friends.

Carlos Perez

![]() Phone: 321-275-5125 Ext. 814

Phone: 321-275-5125 Ext. 814

![]() Email: carlos@shariaportfolio.com

Email: carlos@shariaportfolio.com

Carlos Perez is an award winning and nationally recognized Technology Professional with years of IT Infrastructure at the Microsoft Corporation. Principal of Perez Technology Group, Perez is a Microsoft Certified & Dell Certified Professional who specializes on the development of Technology solutions that solve business needs for small and medium size businesses. He has been responsible for the migration, deployment and management of Cloud based solutions across vertical markets including Fortune 100 companies. He has specialized experience in the Finance, Insurance, Marketing, Legal and Health Care industries & delivered IT projects support to Media Agencies & Non-Profit Organizations.

Perez is also a published author and a featured Tech expert on the Hartford Business Journal & the Orlando Business Journal. He has been featured on the Technology publication CRN, The Channel Company, Spectrum News in Florida, WAPA America, Telemundo NBC Universal & New York 1 for his IT expertise. He was awarded the Entrepreneur of the Year award by the Connecticut Minority Supplier Development Council & the Global Entrepreneur of the Year award by The National Foundation for Teaching Entrepreneurship (NFTE). He previously served as a Manager for Microsoft FastTrack Center, a customer success service designed to help customers realize business value with the Microsoft Azure Cloud and Office 365. Perez is a member of the Microsoft Partner Network & studied Business IT at the University of Connecticut.

Siraj Virji

![]() Phone: 321-275-5125

Phone: 321-275-5125

![]() Email: siraj@sp-funds.com

Email: siraj@sp-funds.com

Siraj is an undergraduate student working toward an MBA with a scholarship at Rollins College. Though having spent a few years in Vancouver, Canada, he has spent most of his life living in Orlando, Florida. Siraj also volunteers as a member of his mosque’s outreach team, coordinating events and writing articles.

Having extensive experience with a myriad of coffee machines, Siraj is equipped with all the skills necessary to produce a colleague’s morning latte in a timely manner. All jokes aside, as he works on the organizational aspects of the company, Siraj is an attentive and diligent worker dedicated to growing as an asset in his role.

Siraj Virji

![]() Phone: 321-275-5125

Phone: 321-275-5125

![]() Email: siraj@sp-funds.com

Email: siraj@sp-funds.com

Siraj is an undergraduate student working toward an MBA with a scholarship at Rollins College. Though having spent a few years in Vancouver, Canada, he has spent most of his life living in Orlando, Florida. Siraj also volunteers as a member of his mosque’s outreach team, coordinating events and writing articles.

Having extensive experience with a myriad of coffee machines, Siraj is equipped with all the skills necessary to produce a colleague’s morning latte in a timely manner. All jokes aside, as he works on the organizational aspects of the company, Siraj is an attentive and diligent worker dedicated to growing as an asset in his role.

Shaykh Umer Khan

![]() Phone: 321-275-5125

Phone: 321-275-5125

![]() Email: umer@shariaportfolio.com

Email: umer@shariaportfolio.com

Shaykh Umer Khan graduated with the highest marks in his class in his formal Shahādah al-‘Ālimiyyah degree (License in Islamic Scholarship, i.e. ʻālim program) from Al-Salam Institute, authorized by Dar al-ʻUlūm Nadwat al-ʻUlamā', Lucknow, India. He also completed a traditional Dars-e-Niẓāmī dawrah of the six canonical books of ḥadīth. Shaykh Umer completed his iftā' (License to Give Islāmic Legal Verdicts) from Darulifta Birmingham, granting him the traditional title of 'mufti'. He has a Master's in Finance (from Wharton, UPenn) and another Master's in Islamic Finance and he holds several professional certifications and qualifications in Islamic Finance.

Shaykh Umer teaches the Islamic sciences at seminaries (Institute of Knowledge, Al-Salam Institute, and Critical Loyalty), researches and writes fatwās (legal verdicts) for various institutions, and serves as a sharīʻah advisor to a number of companies.

Shaykh Umer will be working to help ShariaPortfolio with developing a more concrete framework for Sharia screening, reviewing our operations and portfolios to have better alignment with AAOIFI guidelines. InshaAllah we hope this helps increase confidence with our clients in regard to Sharia compliance.